Are you feeling overwhelmed by financial obligations? Are you constantly worried about paying bills, saving for the future, or making ends meet? If so, you’re not alone. Financial stress is a common problem that can take a toll on your physical and mental health.

Fortunately, there are many things you can do to manage financial stress and improve your overall well-being. This article offers effective strategies to help you cope with money-related anxiety and regain control of your financial situation.

As you delve into this comprehensive guide, you’ll learn practical steps to take charge of your finances, reduce stress, and build a brighter financial future.

Ways to Manage Money Stress

To effectively manage money stress, consider these seven important points:

- Create a budget

- Prioritize debts

- Boost income

- Cut unnecessary expenses

- Save for emergencies

- Seek professional help

- Practice self-care

By following these strategies, you can regain control of your finances, reduce stress, and work towards a brighter financial future.

Create a budget

Creating a budget is the foundation for managing your finances and reducing money stress. It gives you a clear picture of your income, expenses, and where your money is going.

- Track your income and expenses:

Start by tracking all your income sources and expenses, including regular income, side gigs, and variable expenses like entertainment and dining out. Use a budgeting app, spreadsheet, or simply pen and paper.

- Categorize your expenses:

Divide your expenses into categories such as rent/mortgage, utilities, groceries, transportation, and entertainment. This will help you see where your money is going and identify areas where you can cut back.

- Set financial goals:

What do you want to achieve with your budget? Do you want to save for a down payment on a house, pay off debt, or build an emergency fund? Having specific goals will motivate you to stick to your budget.

- Make adjustments as needed:

Your budget should be flexible and adaptable to changing circumstances. Review it regularly and make adjustments as needed to ensure it aligns with your financial goals and current financial situation.

Creating and maintaining a budget is an ongoing process, but it’s worth the effort. By staying disciplined and making adjustments as needed, you can take control of your finances and reduce money-related stress.

Prioritize debts

If you’re struggling with multiple debts, it’s important to prioritize them and develop a strategy for paying them off. This can help you reduce your overall debt burden and save money on interest.

- Make a list of all your debts:

Start by listing all your debts, including credit card balances, loans, and any other money you owe. Include the outstanding balance, interest rate, and minimum monthly payment for each debt.

- Choose a debt repayment method:

There are several popular debt repayment methods, such as the debt snowball method and the debt avalanche method. Choose a method that works best for you and stick to it.

- Make extra payments when possible:

If you have some extra money each month, consider putting it towards your debt repayment. Even a small amount can make a big difference in the long run.

- Consider debt consolidation:

If you have multiple debts with high interest rates, you may want to consider debt consolidation. This involves taking out a new loan to pay off your existing debts, often at a lower interest rate.

Prioritizing your debts and developing a repayment plan can help you get out of debt faster and reduce your financial stress. Remember to stay disciplined and make payments on time to avoid late fees and additional interest charges.

Boost income

If you’re struggling to make ends meet, consider finding ways to boost your income. This can help you reduce your debt, save more money, and improve your overall financial situation.

- Get a part-time job or start a side hustle:

If you have the time and energy, getting a part-time job or starting a side hustle can be a great way to bring in some extra cash. There are many flexible job opportunities available, such as driving for a ride-sharing service or selling handmade goods online.

- Ask for a raise:

If you’ve been with your company for a while and have been consistently exceeding expectations, it may be time to ask for a raise. Be prepared to discuss your accomplishments and how you contribute to the company’s success.

- Invest in yourself:

Investing in your education or skills can lead to higher earning potential in the long run. Consider taking courses, attending workshops, or getting certified in a new field.

- Explore passive income opportunities:

Passive income is money you earn without actively working for it. There are many ways to generate passive income, such as investing in real estate, starting a blog, or creating an online course.

Boosting your income can be challenging, but it’s worth the effort. By exploring different opportunities and being creative, you can find ways to increase your earnings and reduce your financial stress.

Cut unnecessary expenses

One of the most effective ways to reduce your financial stress is to cut unnecessary expenses. This involves taking a close look at your spending and identifying areas where you can save money.

- Review your budget:

Start by reviewing your budget to see where your money is going. Are there any expenses that you can eliminate or reduce? - Cancel unused subscriptions and memberships:

Many people pay for subscriptions and memberships that they rarely or never use. Canceling these services can free up some extra money each month. - Shop around for better deals:

Don’t be afraid to shop around for better deals on insurance, utilities, and other expenses. Switching providers or negotiating a lower rate can save you money. - Pack your lunch:

Instead of eating out or ordering in, pack your lunch to work or school. This can save you a significant amount of money over time. - Reduce your entertainment expenses:

Take a close look at your entertainment expenses. Are there any activities or subscriptions that you can cut back on?

By cutting unnecessary expenses, you can free up more money to pay down debt, save for the future, or simply reduce your financial stress. Remember to be disciplined and make sacrifices where necessary.

Save for emergencies

Having an emergency fund can provide peace of mind and help you avoid taking on debt when unexpected expenses arise. Aim to save at least three to six months’ worth of living expenses in a high-yield savings account or money market account.

- Set a savings goal:

Determine how much money you want to save in your emergency fund. A good rule of thumb is to save at least three to six months’ worth of living expenses.

- Automate your savings:

Set up a system to automatically transfer money from your checking account to your savings account each month. This will make saving easier and more consistent.

- Cut back on unnecessary expenses:

Take a close look at your budget and identify areas where you can cut back on unnecessary expenses. This will free up more money to save.

- Find ways to earn extra money:

If you’re struggling to save money, consider finding ways to earn extra money. This could involve getting a part-time job, starting a side hustle, or selling unused items.

Building an emergency fund takes time and discipline, but it’s worth the effort. Having a financial cushion can help you weather unexpected storms and reduce your financial stress.

Seek professional help

If you’re struggling to manage your money stress on your own, don’t hesitate to seek professional help. A financial advisor can help you create a budget, develop a debt repayment plan, and make other recommendations to improve your financial situation.

A therapist or counselor can help you address the underlying causes of your money stress and develop coping mechanisms. They can also provide support and guidance as you work to improve your financial well-being.

There are many different types of financial professionals and mental health professionals who can help you with money stress. It’s important to find someone who you feel comfortable with and who you can trust.

Here are some tips for finding a qualified professional:

- Ask for recommendations from friends, family, or colleagues.

- Look for professionals who have experience in helping people with money stress.

- Interview several professionals before making a decision.

- Make sure you feel comfortable with the professional’s approach and communication style.

Seeking professional help can be a big step, but it’s worth it if you’re struggling to manage your money stress on your own. A qualified professional can help you develop a plan to improve your financial situation and reduce your stress.

Remember, you’re not alone. Many people struggle with money stress. With the right help, you can overcome this challenge and achieve financial well-being.

Practice self-care

Taking care of your physical and mental health is essential for managing money stress. When you’re stressed, it’s easy to neglect your own needs. However, self-care is not selfish – it’s necessary for your overall well-being.

- Get regular exercise:

Exercise is a great way to reduce stress, improve your mood, and boost your energy levels. Aim for at least 30 minutes of moderate-intensity exercise most days of the week.

- Eat a healthy diet:

Eating a healthy diet will give you more energy and help you better manage stress. Focus on eating plenty of fruits, vegetables, and whole grains.

- Get enough sleep:

When you’re sleep-deprived, you’re more likely to feel stressed and anxious. Aim for 7-8 hours of sleep each night.

- Spend time with loved ones:

Social support is important for mental health. Make time for the people who make you happy and who support you.

- Practice relaxation techniques:

There are many different relaxation techniques that can help you reduce stress, such as deep breathing, meditation, and yoga.

Practicing self-care is not always easy, especially when you’re feeling stressed about money. However, it’s important to make time for yourself and do the things that make you feel good. Taking care of yourself will help you better manage stress and improve your overall well-being.

FAQ

Here are some frequently asked questions about stress management:

Question 1: What are some common signs and symptoms of stress?

Answer: Stress can manifest in many ways, both physically and mentally. Common signs and symptoms include headaches, muscle tension, fatigue, difficulty sleeping, irritability, anxiety, and difficulty concentrating.

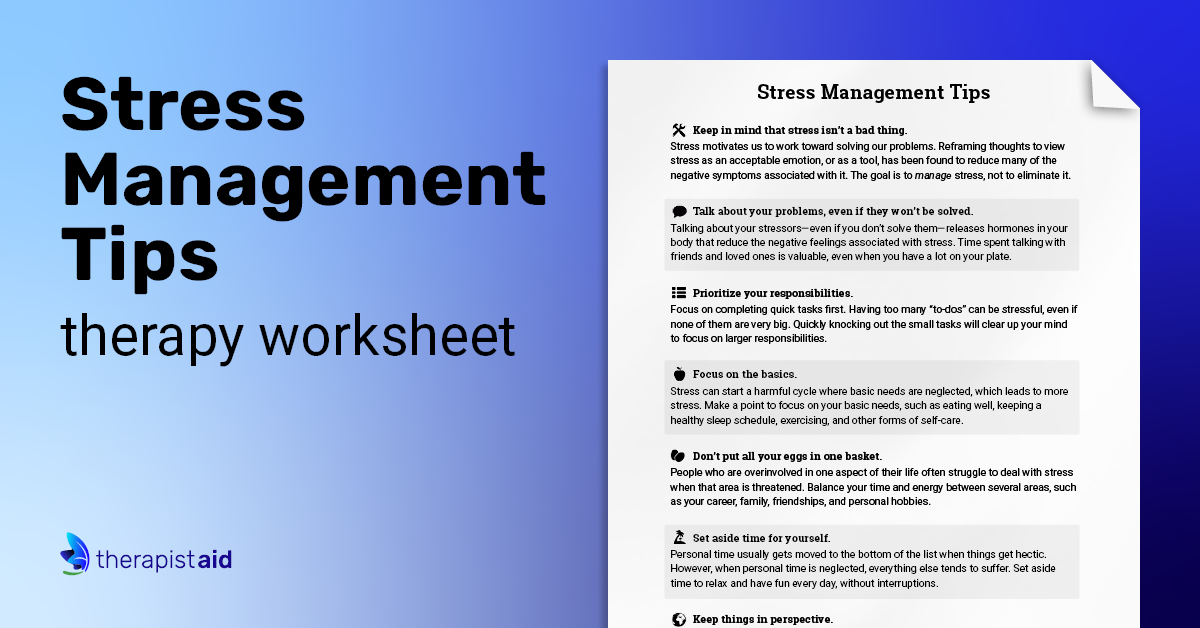

Question 2: What are some effective ways to manage stress?

Answer: There are many effective stress management techniques, such as exercise, relaxation techniques (e.g., deep breathing, meditation, yoga), spending time in nature, practicing mindfulness, and connecting with loved ones.

Question 3: How can I reduce stress at work?

Answer: To reduce stress at work, you can try setting boundaries, prioritizing tasks, taking breaks, practicing effective communication, and seeking support from colleagues or a supervisor.

Question 4: How can I manage stress in relationships?

Answer: To manage stress in relationships, you can try communicating openly and honestly, practicing active listening, setting boundaries, seeking professional help if needed, and engaging in activities that strengthen the relationship.

Question 5: What are some healthy coping mechanisms for dealing with stress?

Answer: Healthy coping mechanisms include exercise, relaxation techniques, spending time with loved ones, engaging in hobbies and interests, practicing self-care, and seeking professional help if needed.

Question 6: How can I prevent stress from negatively impacting my health?

Answer: To prevent stress from negatively impacting your health, you can try maintaining a healthy lifestyle, including a balanced diet, regular exercise, and adequate sleep. Additionally, practicing stress management techniques and seeking professional help if needed can help protect your physical and mental health.

Question 7: Where can I find more information and resources on stress management?

Answer: There are many resources available to help you learn more about stress management, including books, websites, and mental health professionals. You can also find helpful information and support from stress management apps and online communities.

Remember, stress is a normal part of life, but it’s important to manage it effectively to protect your physical and mental health. If you’re struggling to manage stress on your own, don’t hesitate to seek professional help.

In addition to the information provided in this FAQ, there are many other tips and strategies that can help you manage stress. Explore different techniques and find what works best for you.

Images References :

Woody Beck, a happy parents with two kids.