In today’s fast-paced and unpredictable business environment, organizations are faced with a multitude of risks that can potentially jeopardize their financial stability and overall performance. To navigate these challenges effectively, stress testing and other risk management tools have become essential for businesses to identify, assess, and mitigate potential threats.

Stress testing, a key component of risk management, involves simulating various scenarios and adverse conditions to evaluate how an organization’s financial position and operations would hold up under stress. By conducting thorough stress tests, businesses can proactively identify vulnerabilities, quantify potential losses, and implement appropriate measures to minimize the impact of adverse events.

Moving forward, we will delve deeper into the concept of stress testing, explore various types of stress tests, and highlight additional risk management tools that organizations can leverage to safeguard their financial health and achieve long-term success.

stress testing and other risk management tools

Critical components for financial resilience and stability.

- Identifying potential vulnerabilities

- Assessing financial resilience

- Simulating adverse conditions

- Quantifying potential losses

- Implementing mitigation strategies

- Ensuring regulatory compliance

- Enhancing decision-making

- Building investor confidence

- Promoting long-term sustainability

- Safeguarding financial health

By embracing comprehensive stress testing and risk management practices, organizations can navigate challenges, seize opportunities, and achieve long-term success.

Identifying potential vulnerabilities

Identifying potential vulnerabilities is a crucial step in stress testing and risk management. It involves examining an organization’s financial position, operations, and external environment to pinpoint areas that may be susceptible to adverse events. By proactively identifying these vulnerabilities, businesses can prioritize risk mitigation efforts and develop strategies to minimize potential losses.

Several methods can be employed to identify potential vulnerabilities, including:

- Scenario analysis: This involves developing hypothetical scenarios that could potentially impact the organization’s financial health. These scenarios can be based on historical events, industry trends, or expert judgment.

- Sensitivity analysis: This technique involves analyzing how changes in key variables, such as interest rates or exchange rates, affect the organization’s financial performance.

- Stress testing: Stress testing involves simulating extreme but plausible scenarios to assess the organization’s ability to withstand adverse conditions. This helps identify vulnerabilities that may not be apparent under normal operating conditions.

- Risk mapping: Risk mapping is a visual representation of the organization’s risks, their potential impact, and the likelihood of occurrence. It provides a comprehensive overview of the organization’s risk profile and helps prioritize risk mitigation efforts.

By utilizing these methods, organizations can gain a deeper understanding of their vulnerabilities and take proactive steps to mitigate potential risks.

Identifying potential vulnerabilities is an ongoing process, as new risks can emerge over time due to changes in the business environment, regulations, or other factors. Regular risk assessments and stress tests are essential to ensure that organizations remain resilient and adaptable in the face of evolving challenges.

Assessing financial resilience

Assessing financial resilience involves evaluating an organization’s ability to withstand and recover from adverse economic conditions, unexpected losses, or financial shocks. It is a critical aspect of stress testing and risk management, as it helps organizations understand their capacity to absorb losses and continue operating as a going concern.

Several factors contribute to an organization’s financial resilience, including:

- Capital adequacy: This refers to the organization’s ability to meet its financial obligations and absorb unexpected losses. It is typically measured by calculating the organization’s capital ratios, such as the debt-to-equity ratio and the tier 1 capital ratio.

- Liquidity: This refers to the organization’s ability to meet its short-term financial obligations, such as paying bills and salaries. It is typically measured by calculating the organization’s liquidity ratios, such as the current ratio and the quick ratio.

- Profitability: This refers to the organization’s ability to generate profits and cash flow. It is typically measured by calculating the organization’s profit margin and return on equity.

- Diversification: This refers to the organization’s exposure to different markets, products, and customers. A diversified organization is less vulnerable to downturns in any one particular market or industry.

By assessing these factors, organizations can gain a clear understanding of their financial resilience and identify areas where they may need to improve. This information can then be used to develop strategies to strengthen the organization’s financial position and mitigate potential risks.

Assessing financial resilience is an ongoing process, as the organization’s financial position and the external environment are constantly changing. Regular stress tests and risk assessments are essential to ensure that the organization remains resilient and adaptable in the face of evolving challenges.

Simulating adverse conditions

Simulating adverse conditions is a key component of stress testing and risk management. It involves creating hypothetical scenarios that could potentially impact the organization’s financial health and then analyzing how the organization would perform under these conditions. This helps identify vulnerabilities, quantify potential losses, and develop strategies to mitigate risks.

There are various methods for simulating adverse conditions, including:

- Scenario analysis: This involves developing hypothetical scenarios that could potentially impact the organization’s financial health. These scenarios can be based on historical events, industry trends, or expert judgment.

- Sensitivity analysis: This technique involves analyzing how changes in key variables, such as interest rates or exchange rates, affect the organization’s financial performance.

- Stress testing: Stress testing involves simulating extreme but plausible scenarios to assess the organization’s ability to withstand adverse conditions. This helps identify vulnerabilities that may not be apparent under normal operating conditions.

- Monte Carlo simulation: This is a stochastic simulation technique that generates multiple possible outcomes based on a set of input variables. It is often used to assess the likelihood and impact of various risks.

By simulating adverse conditions, organizations can gain a deeper understanding of the potential risks they face and the impact these risks could have on their financial performance. This information can then be used to develop strategies to mitigate these risks and strengthen the organization’s resilience.

Simulating adverse conditions is an ongoing process, as new risks can emerge over time and the organization’s financial position and external environment are constantly changing. Regular stress tests and risk assessments are essential to ensure that the organization remains resilient and adaptable in the face of evolving challenges.

Quantifying potential losses

Quantifying potential losses is a critical step in stress testing and risk management. It involves estimating the financial impact of various adverse scenarios on an organization’s financial performance. This information can then be used to develop strategies to mitigate these losses and strengthen the organization’s financial resilience.

- Identifying potential loss events: The first step in quantifying potential losses is to identify the events that could potentially cause financial losses. These events can be internal, such as operational failures or fraud, or external, such as economic downturns or natural disasters.

- Estimating the likelihood of occurrence: Once the potential loss events have been identified, the next step is to estimate the likelihood of each event occurring. This can be done using historical data, industry trends, or expert judgment.

- Assessing the financial impact: Once the likelihood of occurrence has been estimated, the next step is to assess the financial impact of each event. This involves estimating the direct and indirect costs associated with the event, such as lost revenue, increased expenses, and reputational damage.

- Aggregating the potential losses: Once the financial impact of each event has been assessed, the next step is to aggregate the potential losses from all of the events to determine the total potential loss.

Quantifying potential losses is an ongoing process, as new risks can emerge over time and the organization’s financial position and external environment are constantly changing. Regular stress tests and risk assessments are essential to ensure that the organization remains resilient and adaptable in the face of evolving challenges.

Implementing mitigation strategies

Implementing mitigation strategies is a critical step in stress testing and risk management. It involves developing and implementing actions to reduce the likelihood and impact of potential losses. These strategies can be tailored to the specific risks that an organization faces, and may include:

- Risk avoidance: This involves avoiding activities or situations that could potentially lead to losses. For example, an organization may decide to avoid investing in certain markets or products that are considered to be too risky.

- Risk reduction: This involves taking steps to reduce the likelihood or impact of potential losses. For example, an organization may implement stricter controls to prevent fraud or invest in safety measures to reduce the risk of accidents.

- Risk transfer: This involves transferring the risk to another party. For example, an organization may purchase insurance to transfer the risk of property damage or liability claims.

- Risk acceptance: This involves accepting the risk and taking no action to mitigate it. This is typically done when the cost of mitigation is greater than the potential loss.

In addition to these general strategies, organizations can also implement specific mitigation strategies for different types of risks. For example, to mitigate the risk of economic downturns, an organization may diversify its revenue streams or build up a cash reserve. To mitigate the risk of natural disasters, an organization may invest in disaster preparedness and recovery plans.

Implementing mitigation strategies is an ongoing process, as new risks can emerge over time and the organization’s financial position and external environment are constantly changing. Regular stress tests and risk assessments are essential to ensure that the organization remains resilient and adaptable in the face of evolving challenges.

Ensuring regulatory compliance

Ensuring regulatory compliance is a critical aspect of stress testing and risk management. Financial institutions and other regulated entities are required to comply with a variety of regulations and standards, including those related to capital adequacy, liquidity, and risk management. Stress testing and other risk management tools can help organizations to identify and manage risks in a way that ensures compliance with these regulations.

There are a number of ways in which stress testing and risk management tools can help organizations to ensure regulatory compliance:

- Identifying and assessing risks: Stress testing and other risk management tools can help organizations to identify and assess the risks that they face, including those that could lead to regulatory non-compliance. This information can then be used to develop strategies to mitigate these risks.

- Measuring and monitoring risk exposures: Stress testing and other risk management tools can help organizations to measure and monitor their risk exposures, including those that could lead to regulatory non-compliance. This information can then be used to ensure that the organization is taking appropriate steps to manage these risks.

- Developing and implementing risk management policies and procedures: Stress testing and other risk management tools can help organizations to develop and implement risk management policies and procedures that are designed to ensure regulatory compliance. These policies and procedures should be regularly reviewed and updated to ensure that they are effective and up-to-date.

- Reporting and disclosing risk information: Stress testing and other risk management tools can help organizations to report and disclose risk information to regulators and other stakeholders in a clear and transparent manner. This information can be used to demonstrate the organization’s compliance with regulatory requirements and to build confidence among stakeholders.

Ensuring regulatory compliance is an ongoing process, as regulations and standards are constantly changing. Regular stress tests and risk assessments are essential to ensure that the organization remains compliant and adapts to evolving regulatory requirements.

Enhancing decision-making

Stress testing and other risk management tools can significantly enhance decision-making by providing valuable insights into potential risks and opportunities. By leveraging these tools, organizations can make more informed and strategic decisions that are aligned with their overall objectives and risk appetite.

- Identifying and prioritizing risks: Stress testing and risk management tools help organizations to identify and prioritize the risks that they face, allowing them to focus their resources and attention on the most critical risks.

- Evaluating the impact of decisions: Stress testing and risk management tools can be used to evaluate the potential impact of different decisions on the organization’s financial performance and risk profile. This information can help decision-makers to choose the options that are most likely to achieve the desired outcomes.

- Managing risk exposures: Stress testing and risk management tools can help organizations to manage their risk exposures by identifying and implementing appropriate mitigation strategies. This can help to reduce the likelihood and impact of potential losses.

- Seizing opportunities: Stress testing and risk management tools can also be used to identify opportunities that may arise from changing market conditions or other factors. By being aware of these opportunities, organizations can position themselves to take advantage of them and improve their financial performance.

Overall, stress testing and other risk management tools are invaluable resources for decision-makers, providing them with the information and insights they need to make sound decisions that will benefit the organization in the long run.

Building investor confidence

Stress testing and other risk management tools play a crucial role in building investor confidence by demonstrating an organization’s financial strength and resilience. Investors are more likely to invest in companies that they perceive as being well-managed and able to withstand adverse economic conditions.

- Transparency and disclosure: Stress testing and risk management tools enhance transparency and disclosure by providing investors with detailed information about an organization’s risk profile and financial resilience. This information helps investors to make informed decisions about whether or not to invest in the organization.

- Reduced uncertainty: By identifying and quantifying potential risks, stress testing and risk management tools help to reduce uncertainty for investors. This makes it easier for investors to assess the potential risks and rewards of investing in the organization.

- Increased confidence in financial statements: Stress testing and risk management tools help to ensure the accuracy and reliability of an organization’s financial statements. This increases investor confidence in the financial information that the organization reports.

- Enhanced reputation: Organizations that are seen as being well-managed and financially resilient have a better reputation among investors. This can lead to increased demand for the organization’s securities and a lower cost of capital.

Overall, stress testing and other risk management tools are essential for building investor confidence and attracting capital. By demonstrating an organization’s financial strength and resilience, these tools help to mitigate investment risks and make the organization more attractive to investors.

колон Promoting long-term sustainability

Stress testing and other risk management tools play a vital role in promoting long-term sustainability by helping organizations to identify and mitigate risks that could threaten their financial health and overall viability. By taking a proactive approach to risk management, organizations can position themselves for long-term success.

Here are a few ways in which stress testing and risk management tools contribute to long-term sustainability:

- Enhanced resilience: By identifying and addressing potential risks, organizations can build resilience and become better equipped to withstand adverse economic conditions and other challenges. This can help to protect the organization’s financial performance and reputation over the long term.

- Improved decision-making: Stress testing and risk management tools provide valuable insights that can help organizations make better decisions. By understanding the potential risks and rewards of different courses of action, organizations can make choices that are aligned with their long-term goals and objectives.

- Increased stakeholder confidence: When stakeholders, such as investors, creditors, and customers, see that an organization is taking a proactive approach to risk management, they are more likely to have confidence in the organization’s ability to succeed over the long term. This can lead to increased investment, improved credit ratings, and stronger customer relationships.

- Sustainable growth: By managing risks effectively, organizations can create a foundation for sustainable growth. They can invest in new opportunities, expand into new markets, and develop new products and services, all while managing the risks associated with these endeavors.

In summary, stress testing and other risk management tools are essential for promoting long-term sustainability. By helping organizations to identify, assess, and mitigate risks, these tools can enhance resilience, improve decision-making, increase stakeholder confidence, and support sustainable growth.

Safeguarding financial health

Stress testing and other risk management tools are crucial for safeguarding an organization’s financial health by helping to identify, assess, and mitigate potential risks that could lead to financial distress or failure. By taking a proactive approach to risk management, organizations can protect their assets, maintain profitability, and ensure their long-term viability.

- Early identification of risks: Stress testing and risk management tools help organizations to identify potential risks early on, before they can cause significant financial damage. This allows organizations to take timely action to mitigate these risks and protect their financial health.

- Assessment of financial resilience: Stress testing and risk management tools help organizations to assess their financial resilience and ability to withstand adverse economic conditions. This information can be used to make informed decisions about how to allocate resources and manage risks.

- Mitigation of potential losses: Stress testing and risk management tools help organizations to develop strategies to mitigate potential losses and protect their financial position. This can include measures such as diversifying revenue streams, building up cash reserves, and implementing risk controls.

- Compliance with regulations: Stress testing and risk management tools help organizations to comply with regulatory requirements related to financial stability and risk management. This can help organizations to avoid fines, penalties, and other adverse consequences.

In summary, stress testing and other risk management tools are essential for safeguarding an organization’s financial health. By helping organizations to identify, assess, and mitigate risks, these tools can protect assets, maintain profitability, and ensure long-term viability.

FAQ

Have questions about stress management? Here are some commonly asked questions and answers to help you get started.

Question 1: What is stress management?

Answer 1: Stress management is the process of identifying and managing the sources of stress in your life and developing coping mechanisms to deal with them effectively.

Question 2: Why is stress management important?

Answer 2: Stress can have a negative impact on your physical and mental health, leading to problems such as anxiety, depression, high blood pressure, and heart disease. Effective stress management can help you reduce these risks and improve your overall well-being.

Question 3: What are some common signs of stress?

Answer 3: Common signs of stress include feeling overwhelmed, anxious, or irritable; having difficulty sleeping or concentrating; experiencing physical symptoms such as headaches or stomach problems; and engaging in unhealthy behaviors such as overeating or drinking alcohol.

Question 4: What are some simple stress management techniques?

Answer 4: Simple stress management techniques include deep breathing exercises, meditation, yoga, spending time in nature, and talking to a friend or therapist. Regular exercise and a healthy diet can also help to reduce stress levels.

Question 5: How can I manage stress at work?

Answer 5: To manage stress at work, set realistic goals, prioritize tasks, take breaks throughout the day, and learn to say no to additional responsibilities. It’s also important to communicate openly with your supervisor and colleagues and to create a supportive work environment.

Question 6: How can I manage stress in my personal life?

Answer 6: To manage stress in your personal life, set boundaries, learn to say no to commitments that you don’t have time for, and make time for activities that you enjoy. It’s also important to nurture your relationships with family and friends and to seek professional help if you’re struggling to cope with stress on your own.

Question 7: When should I seek professional help for stress?

Answer 7: If you’re experiencing severe stress that is interfering with your daily life, it’s important to seek professional help. A therapist can help you identify the sources of your stress and develop coping mechanisms to manage it effectively.

Remember, stress management is an ongoing process, and what works for one person may not work for another. The key is to find techniques that help you to manage your stress in a healthy and effective way.

In addition to stress management techniques, here are a few tips to help you reduce stress in your daily life:

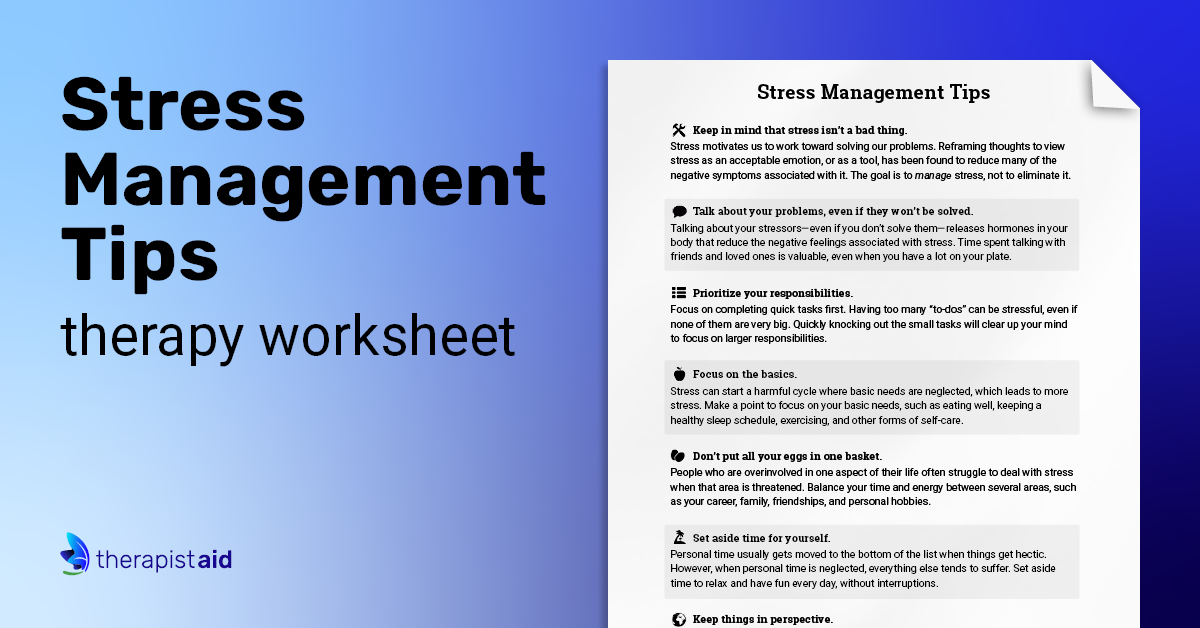

Tips

Here are a few practical tips to help you reduce stress in your daily life:

Tip 1: Identify and avoid stressors

The first step to managing stress is to identify the sources of stress in your life. Once you know what’s causing you stress, you can start to take steps to avoid or reduce these stressors.

Tip 2: Practice relaxation techniques

There are many relaxation techniques that can help to reduce stress, such as deep breathing exercises, meditation, and yoga. Find a relaxation technique that works for you and make it a regular part of your routine.

Tip 3: Get regular exercise

Exercise is a great way to relieve stress and improve your mood. Aim for at least 30 minutes of moderate-intensity exercise most days of the week.

Tip 4: Take care of yourself

Make sure you’re getting enough sleep, eating a healthy diet, and drinking plenty of water. These things are essential for your overall health and well-being, and they can also help to reduce stress.

Tip 5: Talk to someone you trust

Talking about your problems with a friend, family member, therapist, or other trusted individual can help you to feel better and develop coping mechanisms for dealing with stress.

Remember, stress management is an ongoing process, and what works for one person may not work for another. The key is to find techniques that help you to manage your stress in a healthy and effective way.

If you’re struggling to manage stress on your own, don’t hesitate to seek professional help. A therapist can help you to identify the sources of your stress and develop coping mechanisms to manage it effectively.

Conclusion

Stress is a normal part of life, but too much stress can take a toll on our physical and mental health. Stress management is the process of identifying and managing the sources of stress in our lives and developing coping mechanisms to deal with them effectively.

There are many different stress management techniques that can be helpful, such as relaxation techniques, exercise, and getting enough sleep. It’s important to find techniques that work for you and to make them a regular part of your routine.

If you’re struggling to manage stress on your own, don’t hesitate to seek professional help. A therapist can help you to identify the sources of your stress and develop coping mechanisms to manage it effectively.

Remember, stress management is an ongoing process. There will always be stressors in our lives, but by learning to manage them effectively, we can reduce their impact on our health and well-being.

Closing Message: Take control of your stress before it takes control of you. Prioritize your well-being and make stress management a part of your daily routine. By investing in stress management, you’re investing in a healthier, happier, and more fulfilling life.

Images References :

Woody Beck, a happy parents with two kids.