Financial stress is a common problem nowadays. With the rising costs of living and the uncertain economy, it’s no wonder that many people are feeling overwhelmed by their finances. Financial stress can take a toll on your mental and physical health, causing anxiety, depression, and even physical illness. If you’re struggling with financial stress, there are several things you can do to manage it.

It’s important to recognize that you’re not alone. Millions of people are struggling with financial stress, and there are resources available to help. You don’t have to go through this alone.

Taking control of your finances is the first step to managing financial stress. This means creating a budget, tracking your spending, and making a plan to pay off your debts.

Techniques to Manage Financial Stress

Taking control of your finances is the first step to managing financial stress. Here are eight practical techniques to help you get started:

- Create a budget

- Track your spending

- Set financial goals

- Make a debt repayment plan

- Increase your income

- Cut back on expenses

- Seek financial advice

- Take care of your mental health

Remember, managing financial stress takes time and effort, but it’s worth it. By following these techniques, you can take control of your finances and improve your overall well-being.

Create a budget

A budget is a plan for how you’re going to spend your money each month. It helps you track your income and expenses, so you can make sure you’re not spending more than you earn. Creating a budget is the foundation of managing your finances and reducing financial stress.

To create a budget, start by tracking your income and expenses for a month. This will help you see where your money is going and where you can cut back. Once you have a good understanding of your spending habits, you can create a budget that works for you.

There are many different budgeting methods, so find one that fits your lifestyle and needs. Some popular methods include the 50/30/20 rule, the zero-based budget, and the envelope system. Once you’ve chosen a budgeting method, stick to it and review your budget regularly to make sure it’s still working for you.

Creating a budget may seem like a daunting task, but it’s worth it. A budget will help you take control of your finances, reduce financial stress, and achieve your financial goals.

Here are some tips for creating a budget:

- Be realistic about your income and expenses.

- Set financial goals.

- Be flexible and adjust your budget as needed.

- Review your budget regularly.

Track your spending

Once you have a budget, you need to start tracking your spending to make sure you’re sticking to it. This will help you identify areas where you can cut back and make adjustments to your budget as needed.

- Use a budgeting app or spreadsheet. There are many budgeting apps and spreadsheets available that can help you track your spending. Find one that works for you and stick to it.

- Keep receipts. When you make a purchase, keep the receipt so you can track it later. This is especially important for cash purchases.

- Review your spending regularly. Once a week or month, take some time to review your spending and see where your money is going. This will help you identify areas where you can cut back.

- Be honest with yourself. Tracking your spending can be difficult, especially if you’re not used to it. But it’s important to be honest with yourself about your spending habits. If you’re not honest, you won’t be able to make accurate adjustments to your budget.

Tracking your spending is an essential part of managing your finances and reducing financial stress. By tracking your spending, you can identify areas where you can cut back and make sure you’re sticking to your budget.

Set financial goals

Once you have a budget and are tracking your spending, you can start setting financial goals. Financial goals give you something to strive for and help you stay motivated on your journey to financial freedom.

When setting financial goals, it’s important to make sure they are SMART (Specific, Measurable, Achievable, Relevant, and Time-bound). For example, instead of setting a goal to “save money,” set a goal to “save \$10,000 for a down payment on a house by the end of the year.” This goal is specific, measurable, achievable, relevant to your financial situation, and time-bound.

Once you have set your financial goals, write them down and put them somewhere you will see them regularly. This will help you stay motivated and on track.

As you work towards your financial goals, it’s important to be flexible and adjust your goals as needed. Life happens, and sometimes you may need to change your goals or the timeline for achieving them. That’s okay! Just don’t give up on your goals. Keep working towards them, and you will eventually achieve them.

Here are some tips for setting financial goals:

- Make sure your goals are SMART.

- Write down your goals and put them somewhere you will see them regularly.

- Be flexible and adjust your goals as needed.

- Don’t give up on your goals. Keep working towards them, and you will eventually achieve them.

Make a debt repayment plan

If you have debt, creating a debt repayment plan is an important step in managing your financial stress. A debt repayment plan will help you get out of debt faster and save money on interest.

- List all of your debts. Start by listing all of your debts, including the amount you owe, the interest rate, and the minimum monthly payment.

- Choose a debt repayment method. There are several different debt repayment methods, so choose one that works for you. Some popular methods include the debt snowball method, the debt avalanche method, and the balance transfer method.

- Create a budget and stick to it. Once you have chosen a debt repayment method, create a budget and stick to it. This will help you make extra payments on your debt and get out of debt faster.

- Consider getting a side hustle. If you’re struggling to make ends meet, consider getting a side hustle to bring in some extra money. This can help you make extra payments on your debt and get out of debt faster.

Making a debt repayment plan and sticking to it can be difficult, but it’s worth it. By getting out of debt, you can reduce your financial stress and improve your overall financial situation.

Increase your income

If you’re struggling to make ends meet, increasing your income can help you reduce your financial stress. There are many ways to increase your income, such as getting a raise, getting a second job, or starting a side hustle.

- Ask for a raise. If you’ve been with your company for a while and you’re consistently exceeding expectations, you may be able to get a raise. To ask for a raise, schedule a meeting with your boss and come prepared with evidence of your accomplishments. Be polite and respectful, and be willing to negotiate.

- Get a second job. If you have the time and energy, getting a second job can be a great way to increase your income. There are many different types of second jobs available, such as driving for Uber, delivering food for DoorDash, or working as a customer service representative.

- Start a side hustle. If you have a hobby or skill that you’re passionate about, you can turn it into a side hustle. This could be anything from selling handmade goods on Etsy to freelancing your services on Upwork. Side hustles can be a great way to earn extra money and reduce your financial stress.

- Invest in yourself. One of the best ways to increase your income is to invest in yourself. This could mean taking courses to improve your skills, getting a degree, or starting a business. Investing in yourself will pay off in the long run by increasing your earning potential.

Increasing your income can be challenging, but it’s worth it. By increasing your income, you can reduce your financial stress and improve your overall financial situation.

Cut back on expenses

One of the best ways to reduce financial stress is to cut back on expenses. There are many ways to do this, such as cooking at home, canceling unused subscriptions, and shopping around for better deals.

- Cook at home. Eating out can be expensive, so cooking at home is a great way to save money. There are many easy and delicious recipes available online and in cookbooks. You can also meal prep on the weekends to make cooking during the week easier.

- Cancel unused subscriptions. Take a close look at your monthly expenses and see if there are any subscriptions that you’re not using. It’s easy to forget about subscriptions that you signed up for a long time ago, so it’s worth taking some time to review them and cancel any that you don’t need.

- Shop around for better deals. When you’re shopping for groceries, clothes, or other items, take some time to compare prices at different stores. You can also use coupons and promo codes to save money. There are many websites and apps that offer coupons and promo codes, so it’s worth doing a little research before you make a purchase.

- Cut back on unnecessary expenses. Take a close look at your spending and see if there are any areas where you can cut back. For example, do you really need that expensive cable package? Could you get by with a cheaper phone plan? Every little bit counts, so don’t be afraid to make some sacrifices.

Cutting back on expenses can be challenging, but it’s worth it. By cutting back on your expenses, you can reduce your financial stress and improve your overall financial situation.

Seek financial advice

If you’re struggling to manage your finances on your own, don’t be afraid to seek financial advice from a qualified professional. A financial advisor can help you create a budget, develop a debt repayment plan, and make smart investment decisions. Financial advisors can also help you stay motivated and on track.

There are many different types of financial advisors, so it’s important to find one that’s right for you. You can ask your friends, family, or colleagues for recommendations, or you can search for financial advisors online. Once you’ve found a few financial advisors that you’re interested in, schedule a consultation to learn more about their services and fees.

When you’re choosing a financial advisor, it’s important to consider their experience, qualifications, and fees. You should also make sure that you feel comfortable working with them. It’s important to have a good relationship with your financial advisor, so that you can be open and honest about your financial situation.

Working with a financial advisor can be a great way to reduce your financial stress and improve your overall financial situation. Financial advisors can help you make smart financial decisions and stay on track with your financial goals.

Here are some tips for finding a qualified financial advisor:

- Ask your friends, family, or colleagues for recommendations.

- Search for financial advisors online.

- Schedule a consultation with a few financial advisors to learn more about their services and fees.

- Consider the advisor’s experience, qualifications, and fees.

- Make sure you feel comfortable working with the advisor.

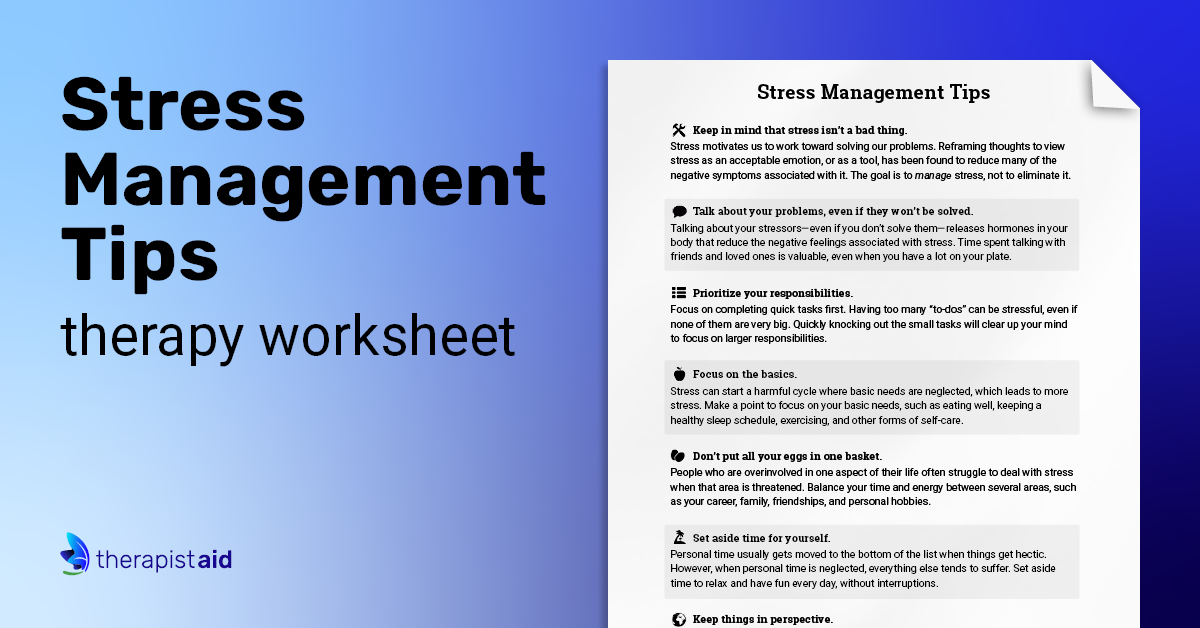

Take care of your mental health

Financial stress can take a toll on your mental health, causing anxiety, depression, and even physical illness. It’s important to take care of your mental health, especially when you’re struggling with financial stress.

There are many things you can do to take care of your mental health, such as:

- Get regular exercise. Exercise is a great way to reduce stress and improve your mood. Aim for at least 30 minutes of moderate-intensity exercise most days of the week.

- Eat a healthy diet. Eating a healthy diet will help you feel better both physically and mentally. Make sure to eat plenty of fruits, vegetables, and whole grains.

- Get enough sleep. When you’re sleep-deprived, you’re more likely to feel stressed and anxious. Aim for 7-8 hours of sleep per night.

- Practice relaxation techniques. There are many relaxation techniques that can help you reduce stress, such as yoga, meditation, and deep breathing exercises.

- Spend time with loved ones. Spending time with loved ones can help you feel supported and loved. Make time for friends and family, even when you’re feeling stressed.

If you’re struggling with your mental health, don’t be afraid to seek professional help. A therapist can help you identify the root of your stress and develop coping mechanisms.

Taking care of your mental health is essential for managing financial stress. By taking care of your mental health, you can reduce stress, improve your mood, and make better financial decisions.

FAQ

Here are some frequently asked questions about stress management:

Question 1: What are some signs of stress?

Answer: Stress can manifest in many ways, both physically and mentally. Some common signs of stress include headaches, muscle tension, fatigue, difficulty sleeping, irritability, anxiety, and depression.

Question 2: What are some healthy ways to manage stress?

Answer: There are many healthy ways to manage stress, such as exercise, yoga, meditation, deep breathing exercises, spending time in nature, and spending time with loved ones. It’s important to find what works for you and make it a regular part of your routine.

Question 3: What are some unhealthy ways to cope with stress?

Answer: Some unhealthy ways to cope with stress include smoking, drinking alcohol, overeating, and gambling. These behaviors may provide temporary relief, but they can actually make stress worse in the long run.

Question 4: When should I seek professional help for stress?

Answer: If you’re struggling to manage stress on your own, it’s important to seek professional help. A therapist can help you identify the root of your stress and develop healthy coping mechanisms.

Question 5: What are some things I can do to prevent stress?

Answer: There are many things you can do to prevent stress, such as getting enough sleep, eating a healthy diet, exercising regularly, and practicing relaxation techniques. It’s also important to learn how to manage your time and set realistic expectations for yourself.

Question 6: What are some resources available to help me manage stress?

Answer: There are many resources available to help you manage stress, such as books, articles, websites, and apps. You can also find support groups and classes in your community.

Question 7: How can I help a loved one who is struggling with stress?

Answer: If you have a loved one who is struggling with stress, there are many things you can do to help. Be supportive and understanding, and encourage them to seek professional help if needed. You can also help them find healthy ways to manage stress, such as exercise, relaxation techniques, and spending time in nature.

Closing Paragraph:

Stress is a normal part of life, but it’s important to manage it in a healthy way. By following these tips, you can reduce stress and improve your overall well-being.

In addition to the tips above, here are some additional tips for managing stress:

Tips

Here are four practical tips for managing stress:

Tip 1: Identify your stressors.

The first step to managing stress is to identify what’s causing it. Once you know what your stressors are, you can start to develop strategies for dealing with them.

Tip 2: Practice relaxation techniques.

There are many relaxation techniques that can help you reduce stress, such as deep breathing exercises, yoga, and meditation. Find a relaxation technique that works for you and make it a regular part of your routine.

Tip 3: Get regular exercise.

Exercise is a great way to reduce stress and improve your mood. Aim for at least 30 minutes of moderate-intensity exercise most days of the week.

Tip 4: Take care of your mental health.

Stress can take a toll on your mental health, so it’s important to take care of yourself. Make sure you’re getting enough sleep, eating a healthy diet, and spending time with loved ones. If you’re struggling with your mental health, don’t be afraid to seek professional help.

Closing Paragraph:

By following these tips, you can reduce stress and improve your overall well-being. Remember, stress is a normal part of life, but it’s important to manage it in a healthy way.

In conclusion, stress is a common problem, but it can be managed. By following the tips above, you can reduce stress and improve your overall well-being.

Conclusion

Stress is a normal part of life, but it’s important to manage it in a healthy way. If you’re struggling with stress, there are many things you can do to reduce stress and improve your overall well-being.

Some of the main points covered in this article include:

- The importance of identifying your stressors.

- The benefits of practicing relaxation techniques.

- The role of exercise in stress management.

- The importance of taking care of your mental health.

- The availability of resources to help you manage stress.

Closing Message:

Remember, you’re not alone. Millions of people struggle with stress every day. By following the tips in this article, you can take control of your stress and live a happier, healthier life.

Images References :

Woody Beck, a happy parents with two kids.